“There’s no such thing as a free lunch” is a phrase that became popular with economists many years ago. The conservative economist Milton Friedman even used it as the title of a book he published in 1975. It’s shorthand for the idea that you can’t really get something for nothing: even if something seems free, you pay for it in one way or another. Is that true?

It depends on who you are. If you could easily afford to pay for your lunch, you’re more likely than ordinary people to find people offering it to you for free. And lunch is the least of what you’ll be offered.

Bernie Sanders, an independent member of the US Senate who describes himself as a “democratic socialist”, asked the Congressional Research Service to find out what some of the biggest US banks did with the government money made available to them in 2008 and 2009 as part of the government’s “stimulus” package to counter the economic crisis.

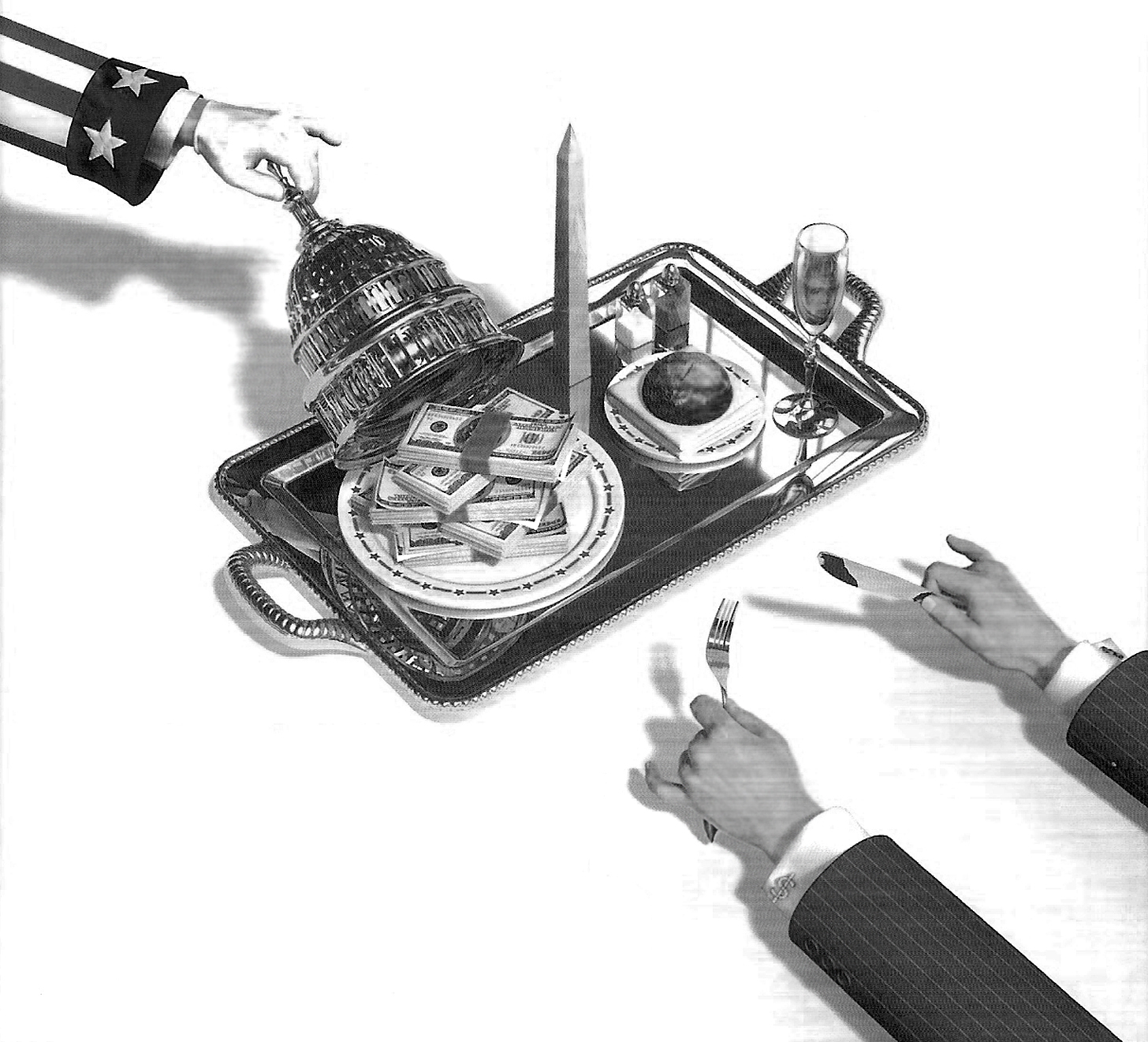

Free money

During that period, the US Federal Reserve made massive loans at very low interest to the largest banks. “The Federal Reserve claimed at the time that the emergency loans were needed so banks could provide credit to small- and medium-sized businesses that desperately needed money to create jobs or to prevent layoffs”, Sanders writes. But that’s not what happened. Many US businesses that needed money at the time were looking a bit shaky. But the federal government has a solid track record of making payments on time. So at least some of the big banks took the money they had just borrowed from the government and loaned it back to the government – at a higher rate of interest.

In a short article on the internet, Sanders provided details of some of the transactions of three of the major US banks: Bank of America, Citigroup and JPMorgan Chase. It is not clear whether or not these examples cover all of the banks’ low-interest borrowings from the Federal Reserve during that period; but even if there were no other similar incidents, huge sums were involved.

Sanders’ article lists only one instance for Bank of America. In the third quarter of 2009, it had outstanding loans from the Federal Reserve of $2.9 billion (all figures here are US dollars) at an interest rate of only 0.25%. At the same time, it had a much larger amount of Treasury securities (i.e. loans to the government) at an average interest rate of 3.2%. In effect, Bank of America was being given a cash gift of 2.95% (3.2% -0.25%) interest on $2.9 billion. In that quarter alone (the situation may have lasted longer than that) this would have amounted to more than $21 million. For free. Here’s $21 million for this quarter; no, don’t thank me – it’s our job to give you money.

JPMorgan Chase did considerably better. According to Sanders, four of its borrowings that were in effect re-loaned to the government brought it profits of more than $205 million.

But top of the charts was Citigroup. Its six loans from the government listed by Sanders gave it a totally risk-free profit of $450 million. Even at expensive restaurants, you can buy a lot of lunches with $450 million.

Who pays

None of these banks actually needed additional money in order to lend to business. They could have sold their Federal Reserve securities and loaned the money to businesses at a higher interest rate. They didn’t because that would have involved some risk, and because the government rewarded their non-lending by giving them free money. Bernie Sanders, after great effort, may eventually manage to pass a law forbidding some of this behaviour. It won’t matter: by then, the banks and other big capitalists will have devised new ways to swindle the rest of us.

That recalls another meaning of the phrase about free lunches, namely that if A receives a free lunch, it’s because B or C is paying for it. That’s what happened in this case: the bankers’ free lunch is being paid for by public workers who are under attack because governments “can’t afford” to pay them a decent wage.